Rupay, Fintech slowdown, Strong Port Cargo and more...

This Week In Data #71

In this edition of This Week In Data we discuss:

Divergent trends in growth of RuPay cards - volumes are declining but value of payments is rising

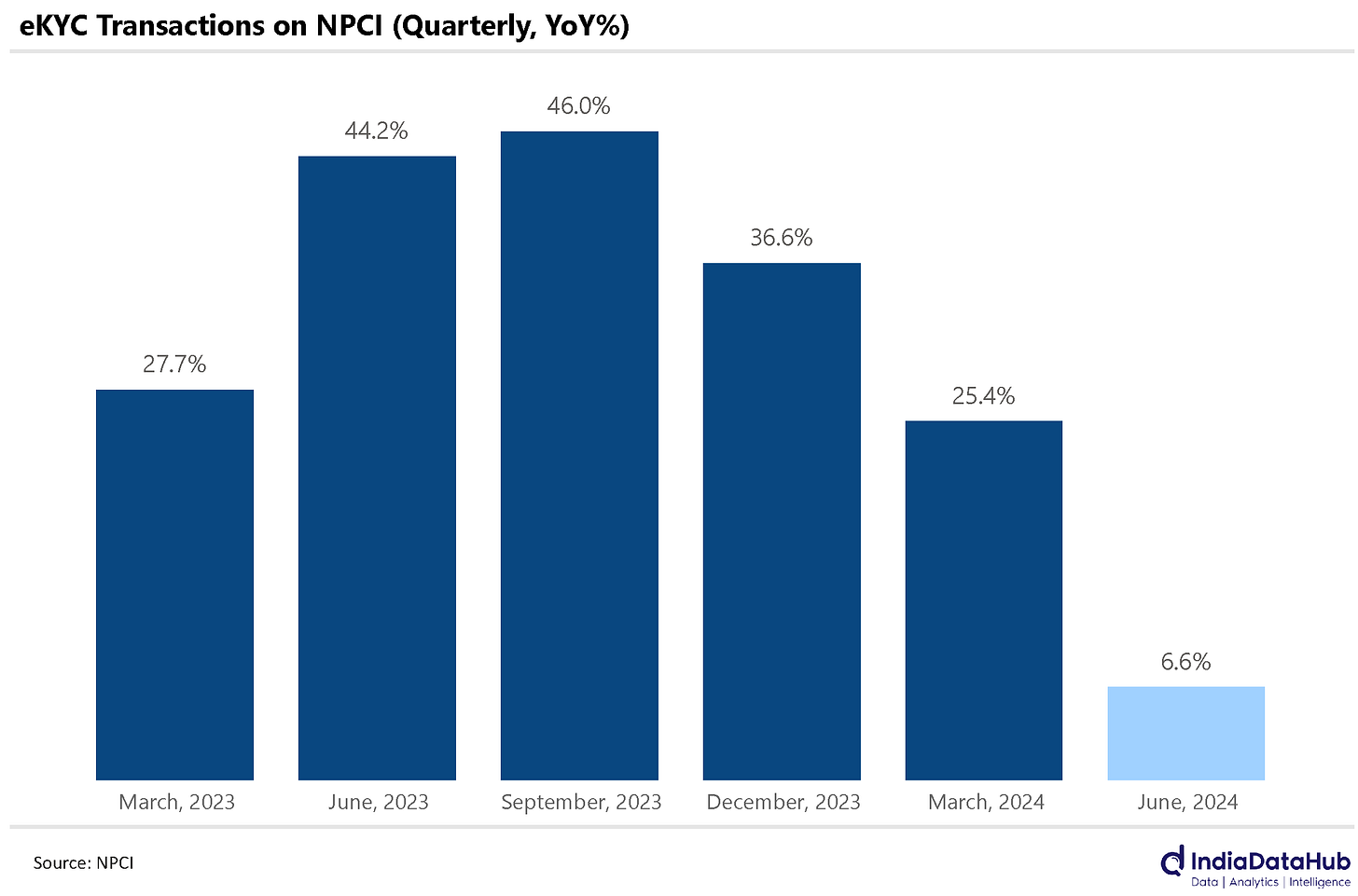

Number of eKYC transactions saw a sharp slowdown during the June quarter

CPI Inflation rose in June but that by itself will not impact RBI’s monetary policy

Robust growth in Cargo carried at Ports and Freight handled by Railways

US CPI falls to 13-month low but CPI accelerates in Brazil and Mexico

In case you missed, we introduced a new feature - User Workspace - on IndiaDataHub this week. User Workspace allows users to customize the dashboards on IndiaDataHub and set them up the way they want. You can bring in cards, charts, and tables from different dashboards into a single workspace. You can set up multiple workspaces and share your workspace with others (even those who are not IndiaDataHub users). All the data is automatically updated, so there is no need to manually update the data! You can see a quick demo from hereRupay, the domestic payment network competing with the likes of Mastercard and Visa is seeing divergent trends. On one hand, the number of transactions processed is continuing to decline. May was the 24th straight month that transactions through Rupay declined. Between June 2022 and June 2024, the total amount of transactions through Rupay has declined by over a third. On the other hand, the value of transactions being processed is increasing. June saw a 17% growth in the value of payments, the 5th consecutive month of double-digit growth. So, value and volume are going in opposite directions.

While we are on payments, the growth in the number of successful eKYC transactions on NPCI has seen a sharp slowdown during the June quarter. The June quarter saw 107 million successful eKYC transactions, a growth of just 7% YoY. In the preceding few quarters, the growth had stayed above 25% YoY. NPCI is just one of the facilitators of eKYC but this does beg the question, is the credit side of the fintech’s seeing a slowdown?

CPI Inflation for June rose to a 4-month high of 5.1% YoY. This was largely driven by higher food inflation. But, and admittedly we are nitpicking, the non-food also CPI rose (by a modest 2bps) after having declined consecutively for 17 straight months. But as we discussed last month, the CPI currently is in a zone which does not warrant the MPC to hike rates and it is clearly not very low – it is still above the RBI’s target of 4% and has averaged 5.8% over the past 5 years.

So, what matters to the RBI and the MPC is growth and as long they are confident that growth will remain strong (the MPC expects GDP growth of over 7% in the current year), there is no reason for it to change the status quo on monetary policy. The data in the last two months has been soft and the MPC will have to take note of that but as we discuss below, the data is not uniformly soft. And the MPC will have an early read of the July data before it next makes a rate decision (in early August). This coupled with the fact the US Fed might be about to start monetary easing and also the fact that we already have two dissensions in the MPC makes the August monetary policy very important.

As we mentioned above, it is not all weak data on the economy. There are some positive prints too. The cargo traffic at the major ports grew by almost 7% YoY in June. This is the highest growth since November last year. This growth was driven by a 13% growth in container traffic. Now, containers generally contain manufactured goods (as against bulk cargo like petroleum or coal etc which cannot be carried in containers) and so they closely approximate the throughput of consumption goods.

And some of this has probably flown through to the Railways where the freight traffic grew 10% YoY. This probably explains the uptick in EWay bills that we discussed last week and also probably explains the weakness in diesel consumption – there is possibly a shift of freight movement from roads to railways that is happening.

Onto the Global data this week, starting with US CPI. Inflation in the US declined to a 13th-month low of 3% in June. This is also the third consecutive month of decline.

And not surprisingly, the markets are getting more confident about a rate cut from the US Fed now. A week ago, the Fed Fund futures were implying a 78% probability of a rate cut in September. As of yesterday, this has increased to 96%. Over the past year, the expectations of a rate cut from the Fed have periodically been pushed out. But this is the highest confidence (probability) that markets have had in an imminent rate cut. So, unless the data flow changes dramatically in the next couple of months, monetary easing in the US is on its way…

China also saw its Inflation decline by 20 basis points to 0.2% YoY in June. However, both Brazil and Mexico saw an uptick in inflation. Inflation in Brazil edged up to a 4-month high of 4.2% YoY in June. Mexico's Inflation increased by 5% in June and was the highest in a year.

From an inflation perspective, China is a bit of an outlier. Brazil and Mexico are more representative of the trends in emerging markets. So, any signs of divergence in inflation between developed and emerging markets need watching especially if it is going to happen at a time when the US Fed (and consequently the other developed world central banks) might be about to start policy easing.

That’s it for this week. Have a good weekend…